Data and customer-centricity are priorities for insurers. Conversational interfaces bring data and customer-centricity together. Having them in one place serves customers better and improves efficiency.

What is a chatbot?

At its core, chatbots (what we also call conversational interfaces and digital employees) are automated programs that conduct conversations, through text or speech, and deliver a contextual responses.

Today, messaging platforms have become the norm. Over one billion people are on Facebook Messenger, 300 million use Skype, and more than six billion have SMS. Naturally, users (like your customers) will gravitate towards businesses that can communicate on any platform.

So, what can it do for your business?

Customer service

Realistically a human can only address a few customers at a time, whereas conversational interfaces, like digital employees can address any number of customers at once, around the clock. Chatbots can reduce the load on call centre staff while improving the speed and quality of the customer service you deliver. And when you consider how digital employees can assume all the monotonous, repetitive tasks a human normally does, it's easy to see why we view them as the perfect human assistant. For insurers, automated conversations can cover common customer requests like checking policies, changing details, adding people to a policy, and making a claim.

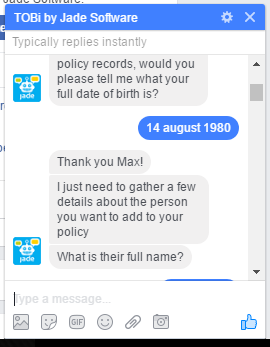

TOBi, a bot built by Jade Software, can help people manage their life insurance policies through Facebook Messenger

Chatbots also add another point of contact for your customers. Think of a customer overseas without a roaming phone who needs to be in touch with you, urgently and after hours. What are their options, other than to send an email and wait? A chatbot provides an instantaneous response that can improve customer’s satisfaction.

CRM and data

To deliver the best possible service for your customer, it’s important to know; recent purchases, current products, adjustments, payment history, refund history, and contact metrics to name a few. This adds to the complexity of every customer interaction. Chatbots are able to take complex data and act on it much faster than any human could — they’re also less likely to miss an important detail or make a rushed decision just to keep a conversation moving.

More than just act on data, these systems continually and contextually engage your customers to encourage decisions, and drive actions. For example, a chatbot can hook into your secure system(s) and send messages that inform your customers of information like expiring policies and new product recommendations. Customers can then interact with this message in their own time and in a way that suits them.

Furthermore conversational interfaces can also generate otherwise inaccessible data. Every interaction is recorded and provides metrics on your customers, sales process, and insights into what’s working and what needs fixing.

Linked to a user’s social media profile, bots can can draw data from those profiles and fast track tedious information requests, like age, marital status, or number of children, speeding up the process and making the process easier for the customer.

We have more information on the types of ROI you can expect from digital employees here.

Behind that hard metal exterior

Behind the scenes is what really makes conversational interfaces special. The implementation of artificial intelligence like machine learning allows these systems to learn from each interaction and improve as they interact.